Posted by Rich Harshaw on June 6, 2017.

I’m dating myself with this story, but oh well.

My oldest son, Sam (24), took driver’s training in 2009.

When the kids in his class would practice driving on the roads, they knew they were supposed to use the turn signal when turning and when changing lanes.

But what about other times?

Did they really have to signal when merging on the highway… or when pulling into a parking spot?

The driving instructor, a no-nonsense kind of guy, always had the same response to the “blinker” question…

“Does it hurt anything? Does it cost anything?”

Point taken.

Now my son still fastidiously signals… pretty much all the time.

Think of this story the next time you ask yourself, “Should I respond to my online reviews?”

Here’s why…

Studies show 92% of people now read online reviews. That makes online reviews one of the most influential aspects of your marketing. Period.

Similarly, most of our clients know they should respond to negative online reviews. It just makes sense: Upset customers need to be dealt with—it’s obvious.

But what about responding to GOOD reviews? Is it really necessary?

“Does it hurt anything? Does it cost anything?”

The truth is, it actually PAYS huge dividends.

Your default position should be to respond to EVERY SINGLE online review.

Yep, all of them.

It’s an easy way to boost SEO. And it can help you drum up more business.

I’ll tell you how in a second.

But first, here is the exact blueprint for responding to good AND bad reviews…

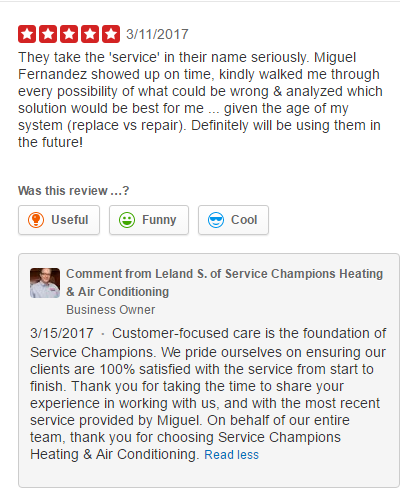

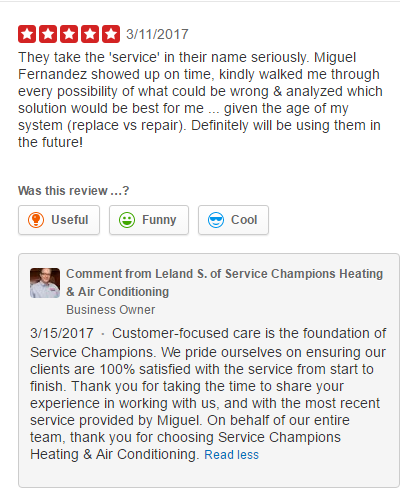

Responding To Good Reviews

- Thank the customer.

- Specifically acknowledge what’s in the review; you want people to know it’s actually you and not an automated response. (“I’m happy to hear [insert employee name] provided a great experience for you.”)

- SEO-ify your response by inserting your company’s name, location, and services. (“At [insert name], we’re proud to be one of [insert location]’s best [insert service].”)

- Market your company. Mention why you were able to provide a great experience. Then, invite your customer to try another of your services and refer their friends.

What Happens When You Respond To Good Reviews:

1) Prospects find you more friendly and caring, so they’re more likely to hire you;

2) your SEO gets a little boost;

3) you get to market your company and showcase your strengths.

Example of responding to a good review:

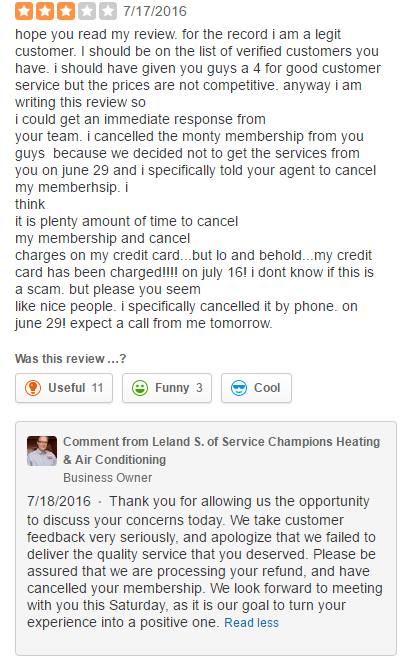

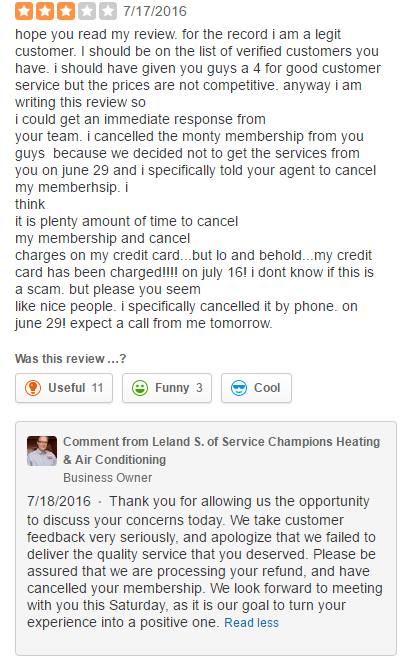

Responding To Bad Reviews

- Say you’re sorry and express sympathy. (“Hi, [Name]. I’m sorry you had a bad experience.”)

- Own up to any mistakes, and explain the type of experience you usually provide. (“We’re known for our attention to detail, and we apologize for missing the mark.”)

- Provide your contact info, so you and the customer can discuss the issue and resolution one on one.

- Keep it concise. No need to go into too much detail and say something that will make your customer more mad.

- Do NOT include SEO stuff like business name, location, and services. It’s best if this review doesn’t show up on Google.

What Happens When You Respond To Bad Reviews: 1) The unsatisfied customer may change their negative review to a positive one; 2) the customer—now happy with you—is more likely to refer you or hire you again; 3) prospects see you fix problems, rather than neglect them, and that peace of mind makes them more likely to hire you.

Example of responding to a bad review:

See? Simple.

The company in these examples is Service Champions. Leland, the owner, responds to literally every single review the company gets—good and bad. And they also happen to be the biggest HVAC company in California.

Here’s the thing…

The kids in my son’s drivers training class already knew the answer to the “blinker” question before they asked. They were just being lazy and didn’t want to reach the three inches to flip the turn signal.

The moral of the story: When it comes to responding to online reviews, don’t be like a lazy teenager.

Follow the blueprint I laid out above to squeeze every last drop of marketing juice out of your online reviews.

After all… it doesn’t hurt anything… and it doesn’t cost anything. 😉

Save

Save

Save

Posted by Rich Harshaw on May 23, 2017.

What if you put your customer references directly on your website?

I’m talking names, phone numbers, and email addresses of at least 15 past customers… and putting them on your website for the world to see. No opt-in required.

Do you think that would help your website conversions?

A better question…

How could putting customer references on your website NOT help conversions?

Think about it…

If you have a strong Identity that’s powerfully communicated on your website, you’re going to need to provide social proof to back up all your big claims.

And there aren’t many better ways to do that than giving prospects an instant way to talk to living, breathing people who have hired you, worked with you, and love you.

Putting references directly on your site—instead of providing them to prospects only when asked for—is also a supreme show of confidence.

You’re telling your prospects, “I’m so confident in my work, I’m giving you the names and numbers of 27 of my customers you can call right here, right now.”

Since calling a stranger can be first date levels of awkward, it’s also a good idea to provide the prospect with a list of “ice-breaker” questions to ask your references. These can include…

- Were you satisfied with the results produced by the company?

- Were there any issues during the project? If so, were they handled appropriately?

- If you needed the company, were they easy to reach and responsive?

- Did you ever feel pressured or stressed by them?

- If you had to do it over, would you choose them again?

Of course, I’ve had contractors object to putting references on their website. Here are the most common ones…

Objection 1: What if my customers don’t want to be on my website?

Easy—don’t put them on your list!

Getting a customer’s written permission is necessary, but you’ll find it is much easier to get than you think.

For example: If you’ve completed 500 jobs, and you’re shooting for a reference list with 20 names, that’s only 4% of your past customer base. Doesn’t that seem doable?

Objection 2: What if my references get too many phone calls?

Then, by all means, remove them from the list.

Let your references know up front that they can request to be taken off your list at any time, whether permanently or just for a breather.

A good solution is to rotate two or three different lists once or twice per month. You will quickly find out that only your most earnestly interested prospects actually take the time to call your list. And most of them actually WAIT until after they’ve engaged you in conversation to actually pick up the phone.

Objection 3: What about my customers’ privacy?

If you don’t want your customers’ names showing up in Google searches, have one of your website geeks code your reference page so it’s not indexed by search engines. This way if someone searches your customer’s name, your webpage will not show up in the results.

Objection 4: What if my competitors see my customer list?

Big deal.

What could your competitors do with the information, exactly? Call your customers, tell them you’re awful and try to make them talk crap about you to your prospects?

Remember, the people on your reference list are HAPPY customers. Your competitors aren’t going to do anything with this list, and even if they did, it wouldn’t affect you in any way.

Asking Can’t Hurt…

Ultimately, there’s no harm in asking your customers to be on your online reference list.

The worst that can happen is that they say “no.” The best that can happen is that you create a powerful form of social proof on your website—one that NONE of your competitors have the guts to utilize.

P.S. Is putting customer references directly on your website a gamble? No, not at all. Simply follow the steps above, and you’ve got a powerful new persuasion tool for your website. Give it a shot!

Posted by Rich Harshaw on May 15, 2017.

Here’s what I know based on concrete statistics:

Financing makes the average sale price go up.

It’s incontrovertible.

And the better the terms, the higher the sale.

Because here is the truth—most homeowners get sticker shock when you tell them their project will cost $10,000 or $20,000 or $40,000 or whatever the number is.

But when you come in with financing, you soften the blow.

The thing is, there is a right way and a wrong way to offer financing.

Most contractors use financing as a last-ditch attempt to salvage a sale. This is the WRONG way.

Instead, sell the monthly payment just like car companies do.

What you do is sit down with the homeowners and say, “Mr. and Mrs. Prospect, we offer several financing options to make this project affordable. How much money do you feel would fit comfortably into your monthly budget to make this project happen?”

(Remember, this is at the beginning—not the end—of the sale.)

If the prospect is not 100% dead set on paying cash upfront (many aren’t, and are open to different options), they will either give you a number or say, “Well, I don’t really know.”

If they don’t know, you say, “What about $200? $300?”

When the prospect gives you a number, say, “OK, you know what, Mr. Prospect? I’ll make you a promise. We can absolutely perform the project you want within your budget of [number] a month.”

If necessary, you can always negotiate the length of the contractor later to make the price fit.

Offering financing this way allows you to close deals faster, easier, and at higher prices.

So when contractors tell me their customers don’t need financing because they all have money, I respond, “That may be true, but how many deals are you losing because the customer did not have the money right then?”

Or…

“That may be true, but how much money in upsells are you losing when your customer has to fork over $10,000 at once, instead of $850 per month?”

One of the best ways I’ve found to offer financing as a first resort is through the GreenSky® Program.

The GreenSky Program is the real deal. Upfront payments. Higher credit limits. Instant credit decisions. No paperwork. No enrollment fee.

Your customers apply for credit during your sales presentation through the GreenSky website, by phone, or through the mobile app. They then get a credit decision almost immediately—sometimes in as little as five seconds.

And when they’re approved, the amount can actually be for more than the cost of the project. This allows you to easily make upsells while staying within your customers’ budgets. Who could possibly pass up replacing their entry door for another $10 per month or upgrading their countertops for $25 per month?

Bottom Line: When you lead with financing through companies like GreenSky, you immediately get your prospects thinking about their projects in small, manageable monthly payments—not a five-figure sum that’s going to leave a gaping hole in their bank accounts.

You’re much more likely to get a “yes”… and for a higher price.

Find out more about the advantages of offering financing through GreenSky on our official MYM GreenSky® page.

Basically, it’s a contractor’s financing dream—and a tool that will melt away price resistance in practically all of your prospects.

* All financing is subject to credit approval and credit qualification. Financing for GreenSky® consumer credit programs is provided by federally insured, federal and state-chartered financial institutions without regard to race, color, religion, national origin, sex or familial status.

Save

Save

Posted by Rich Harshaw on May 8, 2017.

Whether you love or loathe car dealerships, you have to admit: They’ve got upselling down to a science.

And the backbone of their upselling wizardry is how they advertise the cost of a vehicle in low monthly payments, rather than the whole price.

They do this partly to make their vehicles seem more affordable to shoppers.

But the other reason is that breaking the price down into monthly payments makes it MUCH easier to upsell all the bells and whistles.

For instance, put yourself in the shoes of someone looking for a new car.

You find one you like. You sit down with the salesperson, and he tells you he can offer you in the mid-grade model—with all of the standards features and a few extras—for $419 per month.

–OR–

He can put your gluteus maximus in the sporty red and black two-tone leather seat of the high-end model—the one with the touch screen, heated steering wheel, Bose speaker system, and everything but the kitchen sink—for $459 per month. Right here. Right now.

That’s a lot of awesome extra stuff for just $40 more a month. And it’s REALLY hard to pass up.

After all, you’re already going to spend $419 per month… what’s an extra 40 bucks?

This is how car dealerships make upsells left and right with ridiculous ease.

And believe it or not, it’s exactly how you can, too.

Offering your customers financing through the GreenSky® Program gives you the upselling power of the world’s best car salesman.

Here’s how…

When your customer finances through the GreenSky Program, they can be approved for MORE than the cost of the project.

So say you quote your customer a $15,000 window project. The GreenSky Program approves the customer for $18,000.

This gives you the opportunity to earn up to $3,000 in upsells with practically no effort or salesmanship.

Here’s basically all you have to say: “Ms. Smith, with your new windows, you’re sitting at $200 per month. If you’d like, we can also perform that entry door replacement you’ve been thinking about for just $40 more a month.”

The offer is so fantastic that it literally sells itself.

I mean, seriously. How on earth can anyone say “no” to getting a new entry door for a quarter of the cost of their monthly cable bill?

Answer: Almost no one can. And when you upsell with the GreenSky Program, you’ll find not many people will.

And the best part is, everyone comes out on top in this scenario. Your customer gets a beautiful new entry door; you get more money.

Win-win.

But upselling with the GreenSky Program isn’t just for the window and door contractors out there.

If you’re a kitchen remodeler, you can effortlessly upsell your customers on that countertop upgrade. If you build sunrooms, you can get your customers to invest in your most expensive triple-pane windows. And so on.

See for yourself. Fill out the form on our official MYM GreenSky page to get in touch with GreenSky and get set up with the program.

The GreenSky Program requires zero enrollment fee, and you get exclusive “red carpet treatment” for an MYM email subscriber.

What you get that non-subscribers don’t (because you’re special):

- Dedicated account management by your own personal GreenSky representative

- Daily reporting to identify how to get most value from your accounts

- Detail-level finance sales training and program launch training

- New employee training

- Educational opportunities at NARI events and access to ongoing GreenSky research

You literally have nothing to lose and—oh, I don’t know—potentially hundreds of thousands of dollars to gain.

Here’s the link to the MYM GreenSky page again. Fill out the form right now, and a GreenSky rep will get in touch with you shortly.

Happy upselling!

* All financing is subject to credit approval and credit qualification. Financing for GreenSky® consumer credit programs is provided by federally insured, federal and state chartered financial institutions without regard to race, color, religion, national origin, sex or familial status.

Save